tenancy agreement malaysia stamp duty

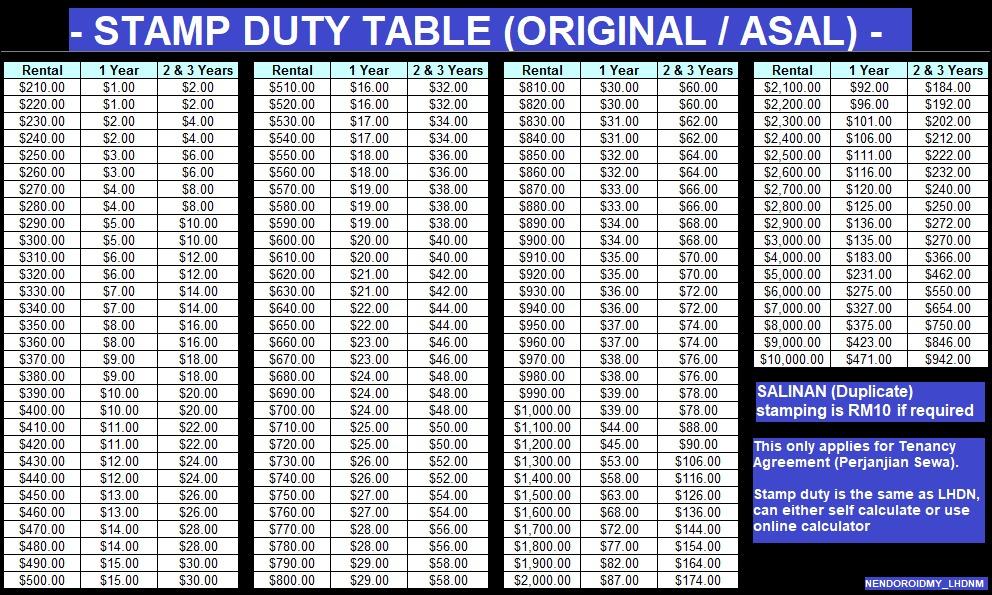

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. This has to be in writing and must specify when the agreement will end.

According to the Registration Act 1908 the registration of a lease agreement is mandatory if.

. The rules around the amount of notice required vary from state to state but landlords generally need to give more notice than the tenant. ASW2020 Unitholders Get 60 sen Dividend for 2018. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

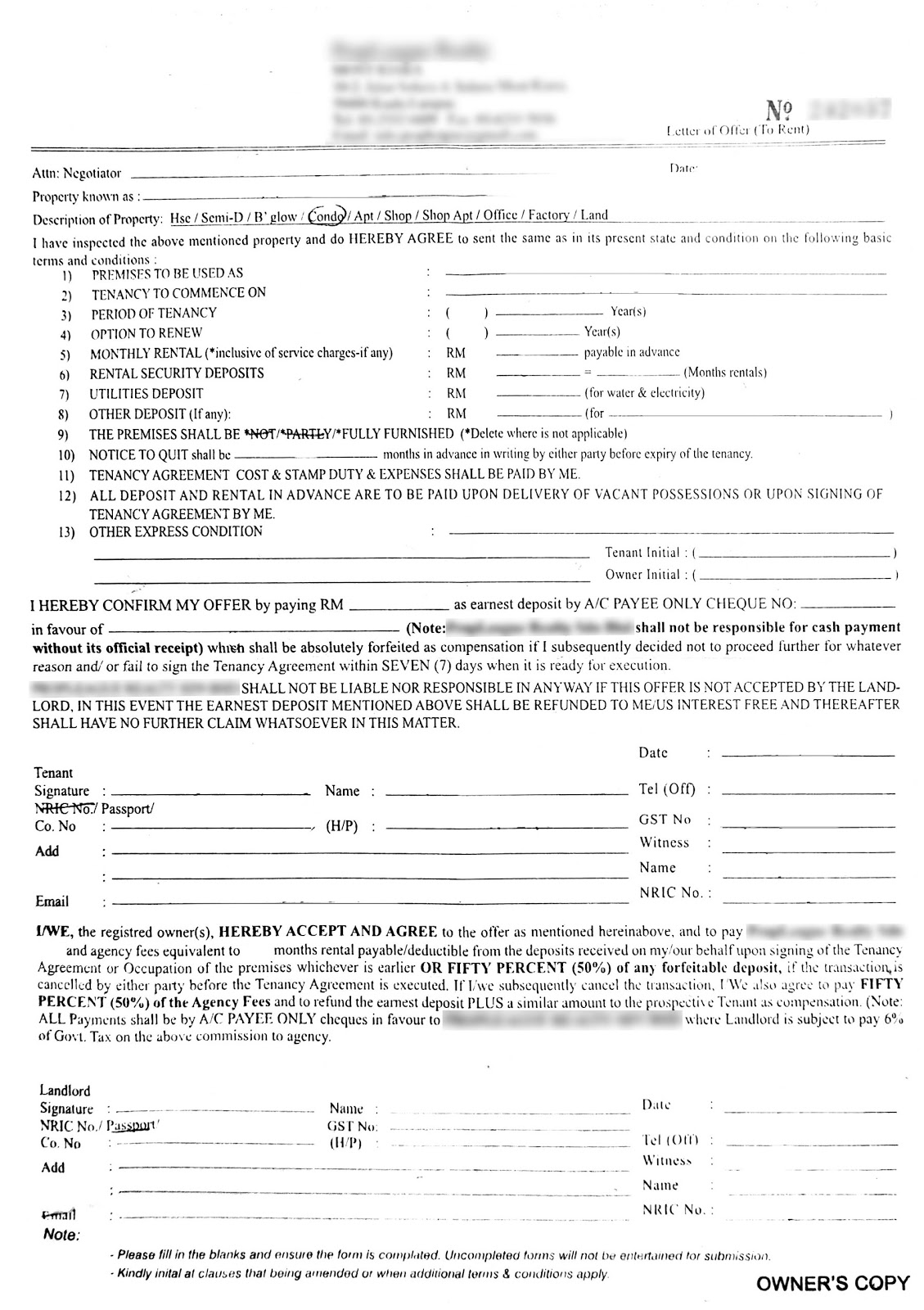

Ii After completion of Tempoh kontrak year tenancy period from the date hereof if the Tenant desires to terminate the Tenancy Agreement before the expiration of the term hereby created the Tenant shall be required to give a three 3 month written notice of such sooner determination. How Much Is Stamp Duty For Tenancy Agreement In 20202021. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

Utilities bil electricity water astro - copy. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250. Stamp duty on rental agreements.

Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia. Personal bond stamped rm 1000 at duty stamp office a copy of applicants passport. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400.

Comparison Between Online Stock Broker in Malaysia. MORTGAGE TAX -- Tax on mortgages usually in the form of a stamp duty levied on the mortgage document. Or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate.

Submit a Letter of Intent LOI to the landlord Step 4. Stamp duty RM1 for every RM250 of the annual rental in excess of RM2400. Genneva Gold Scam Explained.

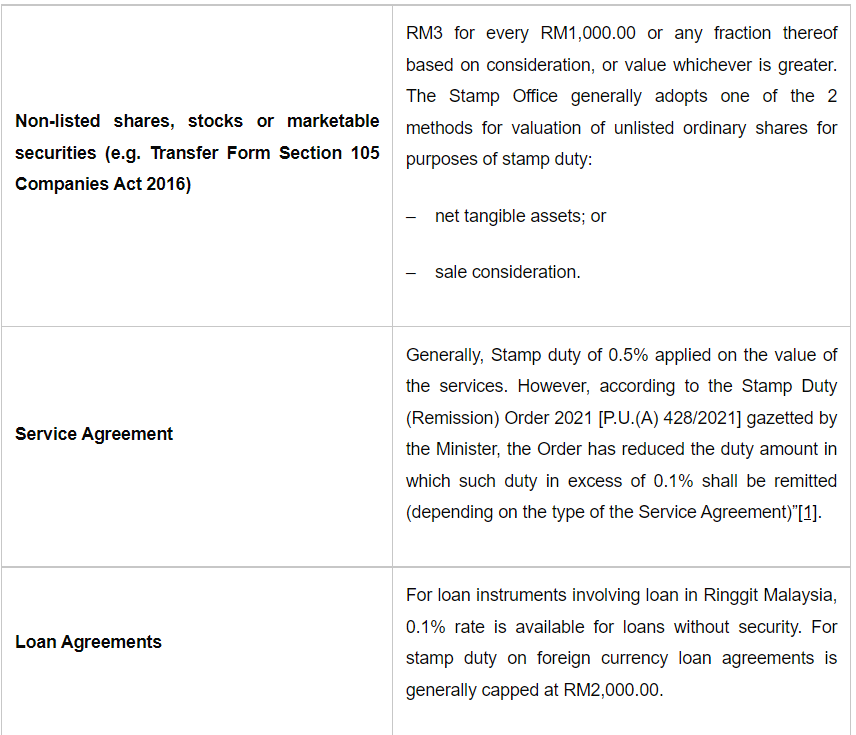

A trust that is created by a person during his or her lifetime with effect from 9 May 2022This will be known as ABSD Trust. Contracts Act 1950 is the legislation which would cover conflicts on the tenancy agreement. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. 1 Legal Calculator App in Malaysia. A periodic tenancy is a month-to-month agreement that continues until either party gives notice.

You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. 500- whichever is lower.

Meanwhile if you wish to know more about the Real Property Gain Tax we recommend users to contact us or download EasyLaw mobile - The No. The stamp duty is free if the annual rental is below RM2400. Pros and cons of periodic tenancy.

Tenancy Agreement Stamp Duty Calculator Malaysia. That means if the annual rental is below RM2400 the stamp duty is free. On 8 May 2022 the Government announced that ABSD of 35 will apply on any transfer of residential property into a living trust ie.

Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs. TNB shall inform the move-in customer once the COT process is successful. Admin Fee Amount RM1000.

The copyright to the. Legal Fee - Sale Purchase Agreement Loan Agreement. Make payment for Processing fee RM3 for LV RM80 for MVHV Stamp Duty RM10 and Security Deposit depends on the premise category.

Shortlist and negotiate the monthly rent Step 3. A full stamp duty exemption is given on. This is effected under Palestinian ownership and in accordance with the best European and international standards.

If the rental provider finds new tenant within a set period defined in the agreement then this amount is reduced. Accordingly use the filters on PropertyGuru and narrow down the choices. For 1-year tenancy agreement.

ASB Unitholders Get Up to 700 sen Dividend. The existing customer the move-out customer shall be contacted by TNB to confirm hisher agreement to close hisher electricity account. MOTIVE TEST -- Test often found in tax rules which are designed to prevent tax avoidance.

Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. Snptenancy agreement - copy. Iii However prior to the completion of a year Tempoh kontrak year period from the date hereof-.

For example the rules may provide that certain consequences will follow if the sole main or principal purpose of certain transaction is the reduction of. As the tenancy agreement was made through a property application on your phone which would have generated andor stored an electronic record of the transaction an electronic document chargeable with stamp duty would be created. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Civil Law Act 1956 is the legislation which would cover payment disputes. Distress Act 1951 is the legislation covering matters of eviction.

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Prepare a list of requirements for your ideal room. And if the Tenancy Agreement has been signed for more than 3 years the.

A copy of principals passport particulars. Also read all about income tax provisions for TDS on rent. How to Open Trading and CDS Account for Trading in Bursa Malaysia.

For 2-year tenancy agreement. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Stamp duty is the governments charge levied on different property transactions.

Specific Relief Act 1950 prohibits a landlord evicting the tenant or making the property inaccessible to tenants without a court order. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Stamp duty is 1 of the total rent plus deposit paid annually or Rs.

As of new laws brought into effect from 2019 tenancy agreements in the ACT may include a lease break fee which is required to be paid by the tenant to the landlord if they wish to end the agreement early. Most rent agreements are signed for 11 months so that they can avoid stamp duty and other charges. As such you would need to pay stamp duty on the lease of the property.

Sign the Tenancy Agreement Step 5. According to local rental listings site Speedrent the stamp duty for tenancy agreements in Malaysia is calculated as follows. Pay the Rental Stamp Duty and move in.

This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. This website belongs to GTRZ. The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your.

RM500 Billion In Debt Is The Malaysian Government Bankrupt. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Residential properties transferred into trusts for housing developers will continue to be subject to the.

Amended Tenancy Agreement 2013

Stamping Of Tenancy Agreement Semionline Property Malaysia

Tenancy Agreement Stamping Service Bluewhale Digital

728 A C Roessler Cachet 1933 Century Of Progress Fdc P 16a Ebay

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

Malaysia Landlord 2018 Legal Fee Stamp Duty My Lawyer

Stamp Duty Malaysia For Tenancy Agreement Archives Malaysia Housing Loan

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

![]()

Tenancy Agreement In Malaysia Lo Partnerslo Partners

Solved One Of The Theories Regarding Initial Public Offering Chegg Com

Stamping Of Tenancy Agreement Semionline Property Malaysia

Malaysian Tax Law Stamp Duty Lexology

Create Cv Dynamic Descriptor Ai Computer Vision Uipath Community Forum

Tenancy Agreement And Security Deposit In Singapore What Renters Must Know 99 Co

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

Comments

Post a Comment